This is just a test dose. Now more to come. The government is committed to clearing the deficit by 2018/19 without increasing income tax or VAT. The chancellor needs to find a further £30bn of savings over the next three years, including £12bn to come out of welfare spending and £13bn from cuts to government departments…reports Kaliph Anaz

British Chancellor George Osborne wields his axe again as the newly re-elected Conservative leader unveiled cuts worth £3.5 billion on departments including the MoD and Home Office besides the sale of government shares in Royal Mail.

The chancellor said the government’s remaining 30% stake in Royal Mail – valued at £1.5bn – would be used to pay down the national debt.

The government holds a 30% stake in the Royal Mail, with the remaining 70% held by a combination of employees and private investors.

Shares in Royal Mail were initially floated at 330p per share, and were trading at 526p at market close on Wednesday but fell 2.5% on Mr Osborne’s announcement.

The £3.5 billion in cuts come ahead of further reductions to be announced in July. The NHS, schools and overseas aid are protected from cuts – but other departments such as the Home Office and MoD will have to find savings.

The government is committed to clearing the deficit by 2018/19 without increasing income tax or VAT. The chancellor needs to find a further £30bn of savings over the next three years, including £12bn to come out of welfare spending and £13bn from cuts to government departments.

Mr Osborne told MPs: “I am today announcing that the Government will begin selling the remaining 30% shareholding we have in the Royal Mail.

“It is the right thing to do for the Royal Mail, the businesses and families who depend on it – and crucially for the taxpayer.

“Further savings in departments this year – and selling our stake in the Royal Mail.

“Getting on with what we promised. Reducing the deficit – that is how you deliver lasting economic security for working people. For as everyone knows, when it comes to living within your means, the sooner you start the smoother the ride.”

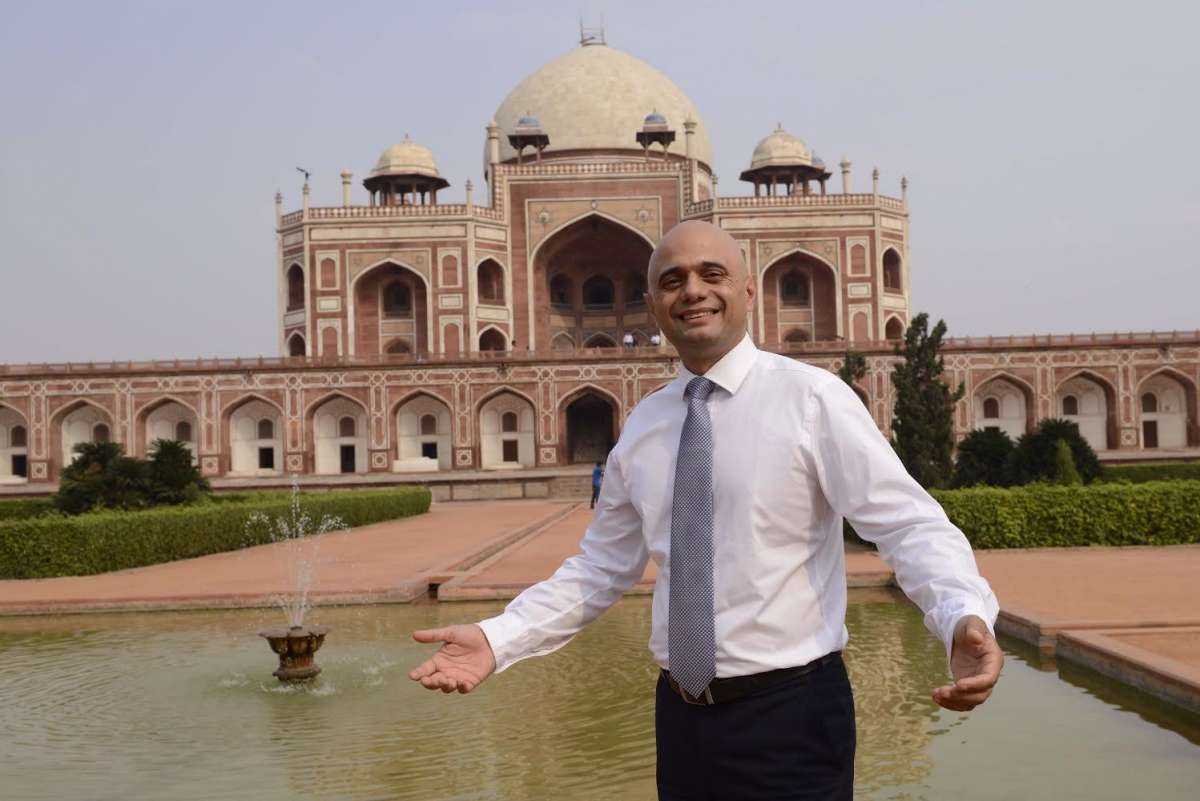

Business secretary Sajid Javid said the Royal Mail sell-off would happen “in the lifetime of this parliament” but that the government would listen to specially-appointed independent advisers about exactly how and when.

“We have plenty of time to work on this. I don’t think it’s the kind of thing we want to rush into in anyway.”

He said his “overriding concern” was to “get the best possible deal for taxpayers”.

Mr Osborne said £3bn in efficiency savings had been achieved by belt-tightening in non-protected government departments and asset sales, including publicly-owned land around King’s Cross station in London.

The savings were made in the Home Office, DWP and Defra and business department including the higher and further education budgets.

The Ministry of Defence will have to find £500m of savings this year, about 1.5% of its total budget.

The MOD says that it will come from “efficiency savings” and will not impact operations or manpower. An MOD source says the cut “could have been worse” and is “manageable” but the BBC understands it might have an impact on the department’s equipment plans.

Mr Osborne will set out full details of future spending cuts in a Budget statement on 8 July.

The director of the Institute for Fiscal Studies, Paul Johnson, said the £3bn worth of cuts in the current financial year was a “useful down payment” but “big difficult decisions” were still required.

“£3bn will be tough to find in a single year but it’s relatively small compared with the very tough target the Chancellor has set himself,” he said.

The IFS has said public spending cuts of 1% a year in 2016-17 and 2017-18 will be more difficult to achieve than was suggested in the Conservative Party’s general election manifesto.

In a statement, the think tank said: “The cuts that the government announces later this year in next month’s Budget and the following Spending Review may turn out to be deliverable.

“But they certainly will not feel like just 1% being taken out of each area of spending, nor will it require merely “£13 billion from departmental savings” as the Conservative manifesto described.

“While not inaccurate, these numbers give a misleading impression of what departmental spending in many areas will look like if the manifesto commitment to eliminate the deficit by 2018-19, largely through spending cuts, while not cutting spending in many areas, is to be met.”

TUC General Secretary Frances O’Grady said: “The chancellor’s plan for fast and extreme cuts will hold back growth, and it will slash the tax credits and vital services that workers and their families rely on.”

Rachel Reeves MP, Labour’s Shadow Secretary of State for Work and Pensions, speaking in response to a report by the IFS on the impact of the government’s plan to cut £12 billion from welfare, said:

“This IFS report suggests families with children will lose out from the Tory plan to cut £12 billion from welfare, with tax credits and child benefit in the firing line.

‘For months David Cameron and George Osborne have ducked questions about which families, children and disabled people will be hit by their £12 billion welfare cut. It’s time for the government to come clean about the impact of their cuts plan on millions of families, children and disabled people.”

The list of cuts:

* Education non-schools – £450m

* Health non-NHS – £200m

* Transport inc. King’s Cross property – £545m

* Communities – £230m

* Business, Innovation and Skills – £450m

* Home Office £30m

* Justice – £249m

* Defence – £500m

* Foreign and Commonwealth Office – £20m

* Energy and Climate Change – £70m

* Environment, Food and Rural Affairs – £83m

* Culture, Media and Sport – £30m

* Work and Pensions – £105m

* HM Revenue and Customs – £80m

* HM Treasury – £7m

* Cabinet Office – £17m