Ashoka Mody, a former mission chief for Germany and Ireland at the International Monetary Fund, is currently Visiting Professor of International Economic Policy at the Woodrow Wilson School of Public and International Affairs, Princeton University.

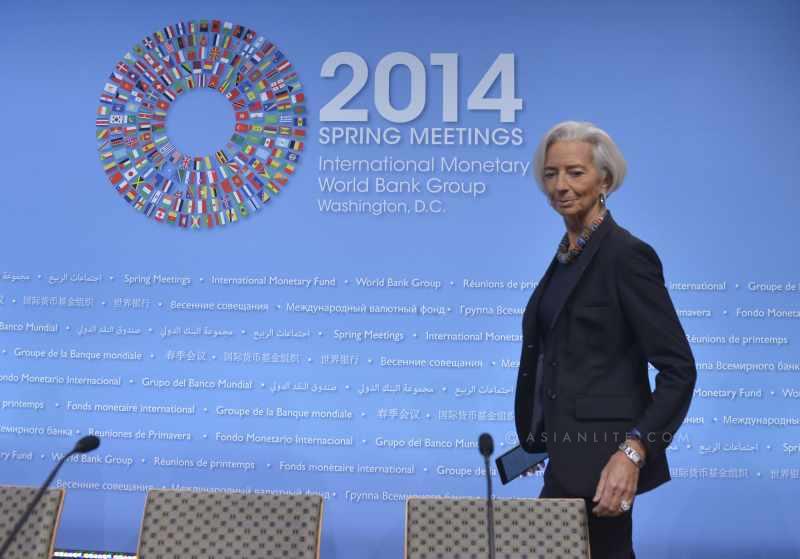

“Do I have to go on my knees?” the International Monetary Fund’s managing director, Christine Lagarde, asked the BBC’s Andrew Marr. Lagarde was apologizing for the IMF’s poor forecasting of the United Kingdom’s recent economic performance, and, more seriously, for the Fund’s longer-standing criticism of the fiscal austerity pursued by Prime Minister David Cameron’s government. Now endorsing British austerity, Lagarde said that it had increased confidence in the UK’s economic prospects, thereby spurring the recent recovery.

Lagarde’s apology was unprecedented, courageous, and wrong. By issuing it, the IMF compromised on an economic principle that enjoys overwhelming academic support: The confidence “fairy” does not exist. And, by bowing to the UK’s pressure, the Fund undermined its only real asset – its independence.

The IMF has dodged responsibility for far more serious forecasting errors, including its failure to anticipate every major crisis of the last generation, from Mexico in 1994-1995 to the near-collapse of the global financial system in 2008. Indeed, in the 6-12 months prior to every crisis, the IMF’s forecasts implied business as usual.

Some claim that the Fund counsels countries in private, lest public warnings trigger the very crisis that is to be avoided. But, with the possible exception of Thailand in 1997, the IMF’s long-time resident historian, James Boughton, finds little evidence for that view in internal documents. The IMF’s Internal Evaluation Office is more directly scathing in its assessment of the Fund’s obliviousness to the US subprime crisis as it emerged.

Given that the IMF is the world’s anointed guardian of financial stability, its failure to warn and preempt constitutes a far more grievous lapse than its position on British austerity, with huge costs borne by many, especially the most vulnerable. For these failures, the Fund has never offered any apology, certainly not in the abject manner of Lagarde’s recent statement.

The Fund does well to reflect on its errors. In a September 2003 speech in Kuala Lumpur, then-Managing Director Horst Köhler conceded that temporary capital controls can provide relief against volatile inflows from the rest of the world. He was presumably acknowledging that the Fund had it wrong when it criticized Malaysia for imposing such controls at the height of the Asian crisis. Among the countries hurt by that crisis, Malaysia chose not to ask for the Fund’s help and emerged at least as well as others that did seek IMF assistance.

Malaysia’s imposition of capital controls was a controversial policy decision. And even as the Fund opposed them, prominent economists – among them Paul Krugman – endorsed their use. In his speech, Köhler reported that the Fund had taken the evidence on board and would incorporate it in its future advice.

But in the current crisis, the academic evidence has overwhelmingly shown that fiscal austerity does what textbook economics says it will do: the more severe the austerity, the greater the drag on growth. A variety of studies confirming this proposition, including one by the IMF’s chief economist, Olivier Blanchard, have withstood considerable scrutiny and leave little room for ambiguity.

The two public voices arguing for the magical properties of austerity are official agencies based in Europe: the OECD and the European Commission. The Commission’s stance, in particular, is animated by an institutional commitment to a fiscal viewpoint that leaves no room for evidence.

Among the G-7 economies, only Italy has done worse than the UK since the Great Recession began. Indeed, the UK’s GDP has only just regained its 2008 level, lagging behind even France.

This is all the more remarkable given that the crisis in the UK was comparatively mild. The fall in property prices was modest relative to Ireland and Spain, and, because there was no construction boom, there was no construction bust. Having missed the warning signs about the bank Northern Rock, which needed to be bailed out by the UK government after a run on its deposits in September 2007, the British authorities, unlike their eurozone counterparts, quickly dealt with the economy’s distressed banks. For these reasons, the UK should have had a quick recovery; instead, the Cameron government’s gratuitous austerity stifled it.

The IMF’s apology was a mistake for two reasons. Thumbing one’s nose at scholarly evidence is always a bad idea, but it is especially damaging to an institution that relies so heavily on the credibility of its technical competence and neutrality. If the Fund embraces muddled economics, on what basis will it defend its policy advice?

Moreover, in choosing to flatter the UK’s misguided policy, the Fund has confirmed its deference to its major shareholders. For years, the view has been that the IMF is a foreign-policy instrument of the United States. The softness in its annual surveillance of UK economic policy has also been well known.

But in taking this latest step, the Fund has undermined – perhaps fatally – its ability to speak “truth to power.” If so, a fundamental question may well become unavoidable: Why does the IMF exist, and for whom?

Ashoka Mody, a former mission chief for Germany and Ireland at the International Monetary Fund, is currently Visiting Professor of International Economic Policy at the Woodrow Wilson School of Public and International Affairs, Princeton University.