British Chancellor George Osborne’s Help to Buy mortgage guarantee scheme may need to be shut down early, the International Monetary Fund warned.

In its annual UK economic health check, the Washington-based institution warned that rising house prices threatened to trigger a new surge in household debt that could destabilise the recovery, and said the Bank of England to take immediate action to stop a dangerous housing bubble inflating, The Times reported.

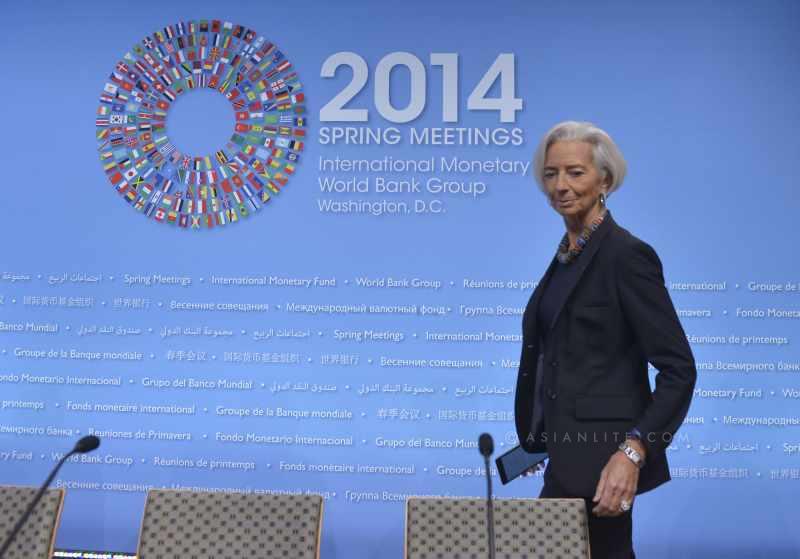

IMF Chief Christine Lagarde gave her blessing to how the Coalition was presently balancing revenue raising and spending cuts to achieve this, saying: “We consider that the current mix is sensible.”

However it nevertheless made a series of recommendations likely to irritate ministers. They include levying VAT on the likes of books, children’s clothes and a range of food and building on the green belt land.

Given Britain’s track record of speculative property bubbles, the IMF?said the Bank should take pre-emptive action, the IMF said, even though it saw little evidence of a housing boom just yet. “Policy action is warranted,” it said in its annual Article IV statement, an assessment of the nation’s economic health.

For the time being, it urged the Bank to consider imposing “limits on the proportion of high loan-to-income mortgages any lender can issue” and increasing the risk weighting of mortgages to make them more expensive for banks to issue.

The fund praised the government’s £12 billion Help to Buy scheme for helping “creditworthy” low income borrowers on to the property ladder, but warned that it could stoke prices and may need to be “modified” or closed down early.