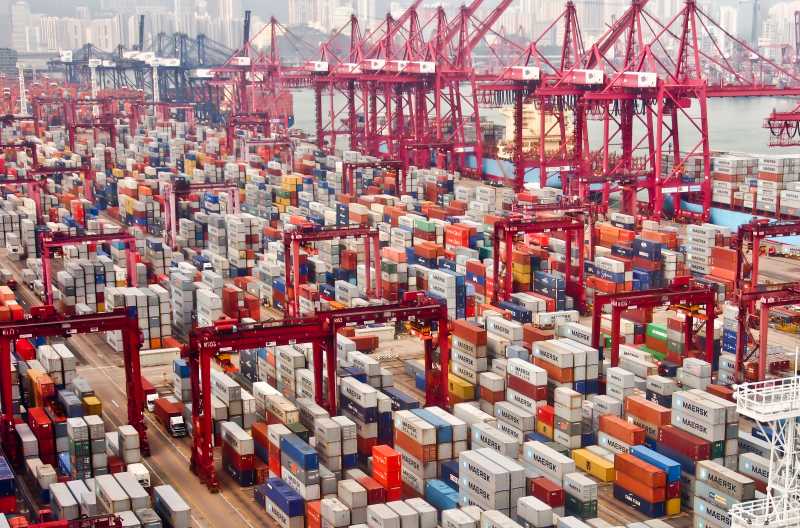

Vatsal Srivastava in his weekly column Currency Corner looks in to the state of Asian exports. Will ‘decoupling’ theory work this time around?

During the financial crisis of 2008, there was a prevailing view among asset managers that a sell-off in developed market (DM) equities would not lead to a downturn in emerging market (EM) equities, especially in Asia. This ‘decoupling’ theory was supported by the fact that Asia could decouple from DM and US demand. It was argued that intra-Asian demand had become more important for Asian exports than DM demand. Further, the loss of DM demand would be offset by China, thus providing a buffer for Asian exporters.

During the financial crisis of 2008, there was a prevailing view among asset managers that a sell-off in developed market (DM) equities would not lead to a downturn in emerging market (EM) equities, especially in Asia. This ‘decoupling’ theory was supported by the fact that Asia could decouple from DM and US demand. It was argued that intra-Asian demand had become more important for Asian exports than DM demand. Further, the loss of DM demand would be offset by China, thus providing a buffer for Asian exporters.

DM equities are now in their sixth year of a bull market after their March 2009 lows. The S&P 500 is only 30 points shy of the 2000 level and Federal Reserve chair Janet Yellen has already warned the financial system of overextended asset prices and a frustrating labour market recovery. It remains to be seen how the US real economy would respond to a rise in real US yields as we approach the complete winding down of the US QE taper. In case we do witness a sharp slowdown in economic activity, which in turn would lead to a correction in the stock market, it is worthwhile going back to the ‘decoupling’ theory and asking if the Asia story would hold up this time around.

In an interesting research note, UBS notes that the bottom line remains that US and DM still look the determining factors which would drive Asian exports. Firstly, they explore the relationship between Asian exports to China versus China’s construction cycle. According to UBS, the Chinese construction cycle clearly has a statistical impact on Asian exports to China and this makes sense analytically, too.

Construction uses chemicals, electrical machinery and transport equipment primarily exported from Japan, Korea and Taiwan, as well as commodities from places like Indonesia. UBS estimates that China’s construction cycle explains roughly 30-40 percent of Asian exports to China. Secondly, UBS compares Asian exports to Chinese exports to the US. This relationship is definitely stronger than the relationship between exports to China and its construction cycle according to UBS. This tells us that DM demand is still driving overall Asian exports and that intra-Asian trade remains disproportionately affected by the outlook for the US capex cycle (which largely drives US demand for imports from Asia) as opposed to the Chinese construction cycle. As per their estimates, China’s exports to the US drive the other 60-70 percent of Asia’s exports to China. Thus, the re-export story to DM is more important than China’s construction cycle for Asian exports. Lastly, UBS synthesizes these competing influences on Asian exports by subjectively assigning a 30 percent weight to growth in Chinese construction and a 70 percent weight to the impact of China’s exports to the US (the re-export story). Using UBS’s current assumptions on growth for the US and China over the next year or two, Asian exports should remain stuck in mid-single export growth – perhaps high-single digit growth, but well below long-term trend growth. Thus, decoupling is not a theme investors looking at EM Asian equities should be assigning a high probability to.

It is interesting to note that among the large Asian economies, India does not figure in the ‘decoupling’ debate due to the low contribution of exports to GDP. However, at the end of the day, whether economies are coupled or decoupled, global fund flows would turn negative if there is a sell-off in US equities.