Labour’s proposed Mansion Tax to raise funds to shore up NHS is a tax of envy on the aspirations of hard working Britons…writes Dr Rami Ranger

The British Labour party’s method of coming to power is by promising voters more than the nation can afford in terms of public services or benefits. Their solution is to tax the hard working wealth creators who will always sacrifice more for the sake of their ambition and aspirations. Voters on the whole do not like to have difficult fiscal policies imposed upon them as it means telling them to live within their means.

The British Labour party’s method of coming to power is by promising voters more than the nation can afford in terms of public services or benefits. Their solution is to tax the hard working wealth creators who will always sacrifice more for the sake of their ambition and aspirations. Voters on the whole do not like to have difficult fiscal policies imposed upon them as it means telling them to live within their means.

As Labour always want to be popular with voters, they find it easy to rob successful hardworking people through higher taxes and pay for the promises they make before elections. The temporary feel good factor plunges the nation into debt for generations whenever they come to power. Many businesses go bust due to high taxes which make them unable to compete with businesses based in low tax countries. The result is that less and less people remain in work to generate wealth with more people on benefits. It is a double whammy for those who were promised a panacea but find themselves in the trap of high unemployment, inflation and low income. Higher taxes and spend policies also result in a brain drain as many companies relocate to avoid punitive tax burdens. Productivity also suffers due to a lack of incentive to work hard. The Public services suffer more due to less income and high demands created by those who either cannot find work or have no incentive to work.

Now Labour has come up with a new tax, the so called ‘Mansion Tax’ whereby imposing a new tax on any property worth £2 million or more. This is a slippery slope as this tax can soon move on the properties worth less and so on. With the escalating property prices, millions of houses will join the £2 million band each year. Frankly, Labour’s mansion tax is in reality an arbitrary confiscation of wealth which would start off by targeting properties in expensive inner cities and then eventually be extended much more broadly.

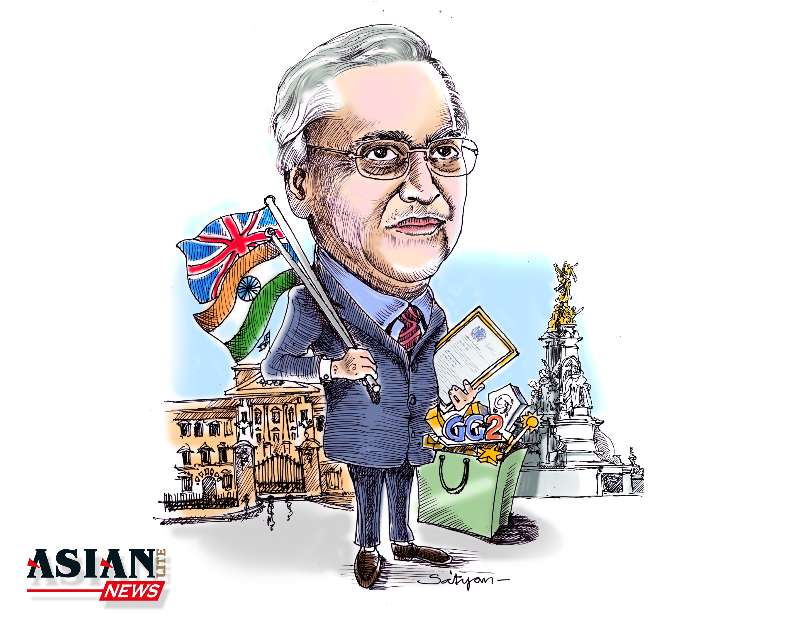

As a businessman with five Queen’s Awards for Enterprise to my credit and an impeccable business records, I can categorically say that such draconian wealth taxes are ethically wrong and immoral. They are also disastrously inefficient in economic terms as they fatally undermine the right to own property, the very fact which underpins the free-market economic system where individuals are encouraged to take on a bigger share of responsibility to manage their own affairs when the state is less intrusive. The effect of such a tax will result in freeholders becoming leaseholders and will be forced to pay an additional annual tax to the state for the privilege of being allowed to keep hold of what was once their inheritance or the fruits of their hard labour.

Sadly, those who are unable to pay will have to use their savings which will soon disappear because their earnings would be taxed heavily. As a result, many will be forced to sell their cherished possessions and move into less expensive property.

The irony is that the less expensive property can also become more expensive due to the demand generated by high taxes on expensive properties. As a result, – housing shortage. Pensioners who bought their homes decades ago would be hit especially badly. They will have no means to increase their income to pay for this additional burden.

The idea that excessive taxes on property is acceptable is a dangerous notion. This policy can force people to opt for public housing paid for by the tax payers. The result, a total disaster for all concerned. The homeowners looking after their own homes will now become tenants of the state making a big hole in the public spending which could otherwise have gone towards health and education.

It is a fallacy to believe that Labour is a friend of Public Services. How can any Government sustain a high level of services in the absence of a strong economy which is needed to sustain them?

You have been warned. Please cast your vote in such a way that your decision does not haunt you or your next generation.